Study the IRR Problem from http://en.wikipedia.org/wiki/Internal_rate_of_return (partial extract shown below).

But what happens when payments are NOT DETERMINISTIC but are STOCASTIC from a known distribution?

| View the IRR Problem (with a Case 0 and Case 1 solution) in html. | |

| View the IRR Problem as a pdf. | |

| View a 2009 USC Thesis Paper by Ms. Gokce Palak written on the subject. Her Masters Thesis |

From Wikipedia for a general description:

The internal rate of return on an investment or potential investment is the annualized effective compounded return rate that can be earned on the invested capital.

In more familiar terms, the IRR of an investment is the interest rate at which the costs of the investment lead to the benefits of the investment. This means that all gains from the investment are inherent to the time value of money and that the investment has a zero net present value at this interest rate.

Because the internal rate of return is a rate quantity, it is an indicator of the efficiency, quality, or yield of an investment. This is in contrast with the net present value, which is an indicator of the value or magnitude of an investment.

An investment is considered acceptable if its internal rate of return is greater than an established minimum acceptable rate of return. In a scenario where an investment is considered by a firm that has equity holders, this minimum rate is the cost of capital of the investment (which may be determined by the risk-adjusted cost of capital of alternative investments). This ensures that the investment is supported by equity holders since, in general, an investment whose IRR exceeds its cost of capital adds value for the company (i.e., it is profitable).

Given a collection of pairs (time, cash flow) involved in a project, the internal rate of return follows from the net present value as a function of the rate of return. A rate of return for which this function is zero is an internal rate of return.

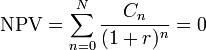

Given the (period, cash flow) pairs (n, Cn) where n is a positive integer, the total number of periods N, and the net present value NPV, the internal rate of return is given by r in:

Note that the period is usually given in years, but the calculation may be made simpler if r is calculated using the period in which the majority of the problem is defined (e.g., using months if most of the cash flows occur at monthly intervals) and converted to a yearly period thereafter.

Note that any fixed time can be used in place of the present (e.g., the end of one interval of an annuity); the value obtained is zero if and only if the NPV is zero.

In the case that the cash flows are random variables, such as in the case of a life annuity, the expected values are put into the above formula.

Often, the value of r cannot be found analytically. In this case, numerical methods or graphical methods must be used.